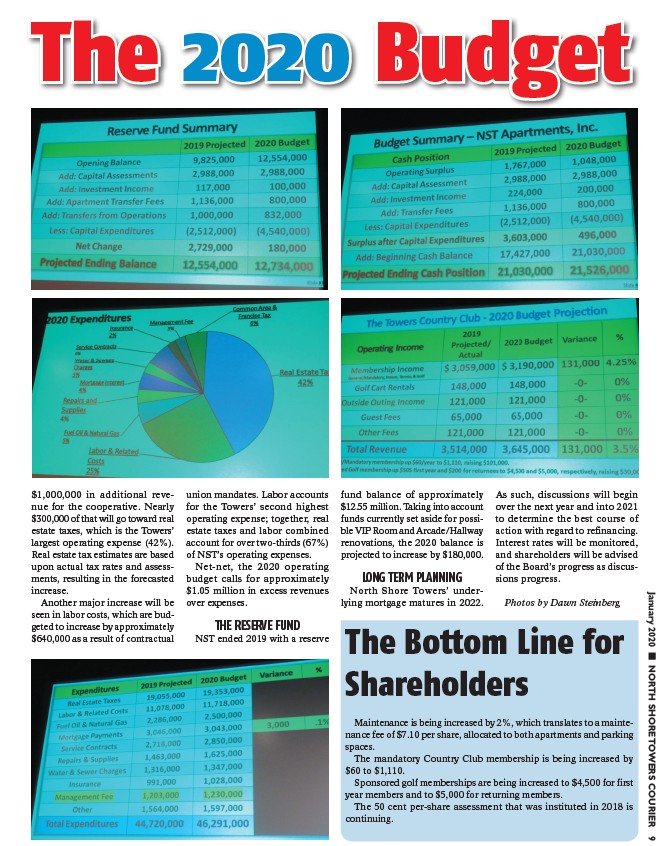

The 2020 Budget

$1,000,000 in additional revenue

for the cooperative. Nearly

$300,000 of that will go toward real

estate taxes, which is the Towers’

largest operating expense (42%).

Real estate tax estimates are based

upon actual tax rates and assessments,

resulting in the forecasted

increase.

Another major increase will be

seen in labor costs, which are budgeted

to increase by approximately

$640,000 as a result of contractual

union mandates. Labor accounts

for the Towers’ second highest

operating expense; together, real

estate taxes and labor combined

account for over two-thirds (67%)

of NST’s operating expenses.

Net-net, the 2020 operating

budget calls for approximately

$1.05 million in excess revenues

over expenses.

THE RESERVE FUND

NST ended 2019 with a reserve

fund balance of approximately

$12.55 million. Taking into account

funds currently set aside for possible

VIP Room and Arcade/Hallway

renovations, the 2020 balance is

projected to increase by $180,000.

LONG TERM PLANNING

North Shore Towers’ underlying

mortgage matures in 2022.

As such, discussions will begin

over the next year and into 2021

to determine the best course of

action with regard to refinancing.

Interest rates will be monitored,

and shareholders will be advised

of the Board’s progress as discussions

progress.

Photos by Dawn Steinberg

The Bottom Line for

Shareholders

Maintenance is being increased by 2%, which translates to a maintenance

fee of $7.10 per share, allocated to both apartments and parking

spaces.

The mandatory Country Club membership is being increased by

$60 to $1,110.

Sponsored golf memberships are being increased to $4,500 for first

year members and to $5,000 for returning members.

The 50 cent per-share assessment that was instituted in 2018 is

continuing.

January 2020 ¢ NORTH SHORE TOWERS COURIER 9