16 LONGISLANDPRESS.COM • DECEMBER 2018

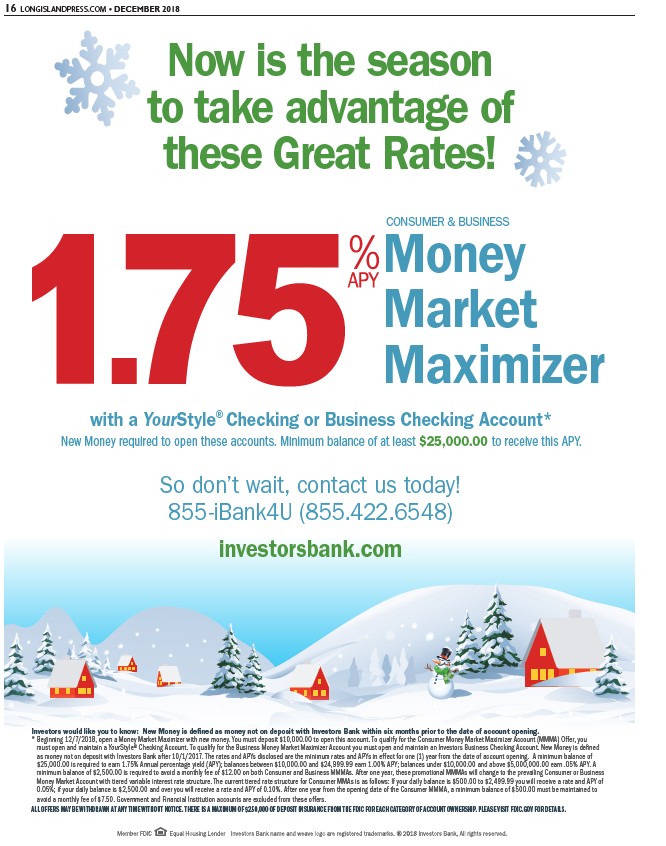

Now is the season

to take advantage of

these Great Rates!

CONSUMER & BUSINESS Money

Market

Maximizer

with a YourStyle®Checking or Business Checking Account*

New Money required to open these accounts. Minimum balance of at least $25,000.00 to receive this APY.

So don’t wait, contact us today!

855-iBank4U (855.422.6548)

investorsbank.com

Investors would like you to know: New Money is defined as money not on deposit with Investors Bank within six months prior to the date of account opening.

* Beginning 12/7/2018, open a Money Market Maximizer with new money. You must deposit $10,000.00 to open this account. To qualify for the Consumer Money Market Maximizer Account (MMMA) Offer, you

must open and maintain a YourStyle® Checking Account. To qualify for the Business Money Market Maximizer Account you must open and maintain an Investors Business Checking Account. New Money is defined

as money not on deposit with Investors Bank after 10/1/2017. The rates and APYs disclosed are the minimum rates and APYs in effect for one (1) year from the date of account opening. A minimum balance of

$25,000.00 is required to earn 1.75% Annual percentage yield (APY); balances between $10,000.00 and $24,999.99 earn 1.00% APY; balances under $10,000.00 and above $5,000,000.00 earn .05% APY. A

minimum balance of $2,500.00 is required to avoid a monthly fee of $12.00 on both Consumer and Business MMMAs. After one year, these promotional MMMAs will change to the prevailing Consumer or Business

Money Market Account with tiered variable interest rate structure. The current tiered rate structure for Consumer MMAs is as follows: If your daily balance is $500.00 to $2,499.99 you will receive a rate and APY of

0.05%; if your daily balance is $2,500.00 and over you will receive a rate and APY of 0.10%. After one year from the opening date of the Consumer MMMA, a minimum balance of $500.00 must be maintained to

avoid a monthly fee of $7.50. Government and Financial Institution accounts are excluded from these offers.

ALL OFFERS MAY BE WITHDRAWN AT ANY TIME WITHOUT NOTICE. THERE IS A MAXIMUM OF $250,000 OF DEPOSIT INSURANCE FROM THE FDIC FOR EACH CATEGORY OF ACCOUNT OWNERSHIP. PLEASE VISIT FDIC.GOV FOR DETAILS.