MEDICARE CORNER

YOUR MEDICARE COSTS SHARING 2018

PART B 2018

If enrolled in a Medicare Advantage Plan (Part

C) premium and other costs sharing varies by

Plan. Compare costs for Part C Plans in your

2018 “Medicare & You” handbook, starting on

page 132.

2018 Part B Deductibles:

Part B Deductible $183

What You Will Pay in 2018 For Your Part

B and D Premium if Your Annual Income in

2016 Was:

BY FELICE HANNAH

• If you have health coverage and/or prescription

drug coverage from your Employer, Union,

COBRA, Federal Employee or Veteran Benefits,

check with your Human Resource Manager,

regarding your cost sharing and coverage.

• If you are receiving your health coverage

through a Medicare Advantage Plan (Part C),

check with the Plan regarding your cost sharing.

• If you are enrolled in the Affordable Care

Act Health Exchange Program and eligible for

Medicare Enrollment, you may be charged a

Part B Penalty if you do not enroll at the time

of eligibility.

PART A 2018

Most people do not pay a Part A Premium. The

Social Security Administration will assist you in

determining if you have “Premium Free Part A.”

2018 Part A Inpatient Deductibles and

Coinsurance Per Benefit Period:

A Benefit Period (days 1–90) begins on day

of admission to a hospital or Skilled Nursing

Facility (SNF). A new Benefit Period begins If

you have not received any skilled services as

an inpatient in a hospital or SNF for 60 days

in a row. You may have several Benefit Periods

during the year. Benefit Periods reset on January

1 of each year.

Cost Sharing during a Benefit Period:

Deductible $1,340 per Benefit Period.

Day 1–60: $0 coinsurance

Days 61–90: $335 coinsurance per day

Days 91 and up to 60 days of “lifetime reserve

days”: $670 per day

Beyond “lifetime reserve days” you pay

all costs

Skilled Nursing Facility Costs:

Note: Days spent as a hospital inpatient count

towards days in an SNF

Days 1–20: $0 coinsurance

Days 21–100: $167.50 coinsurance per day

All costs beyond days 101

2018

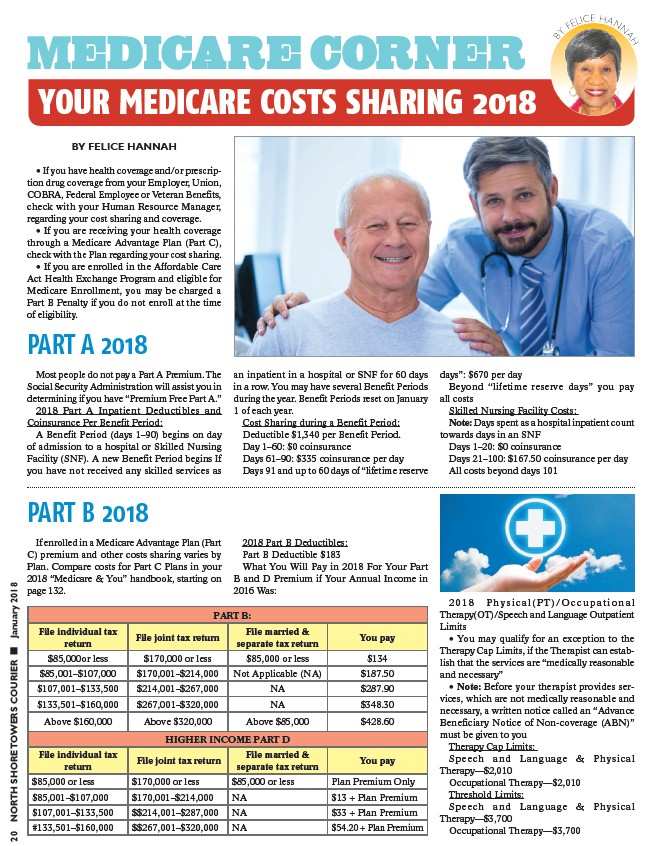

January PART B:

File individual tax

File married &

File joint tax return

You pay

return

separate tax return

¢COURIER $85,000or less $170,000 or less $85,000 or less $134

$85,001–$107,000 $170,001–$214,000 Not Applicable (NA) $187.50

$107,001–$133,500 $214,001–$267,000 NA $287.90

TOWERS $133,501–$160,000 $267,001–$320,000 NA $348.30

necessary, a written notice called an “Advance

Above $160,000 Above $320,000 Above $85,000 $428.60

Beneficiary Notice of Non-coverage (ABN)”

HIGHER INCOME PART D

must be given to you

Therapy Cap Limits:

SHORE File individual tax

File married &

File joint tax return

You pay

Speech and Language & Physical

return

separate tax return

Therapy—$2,010

$85,000 or less $170,000 or less $85,000 or less Plan Premium Only

Occupational Therapy—$2,010

NORTH $85,001–$107,000 $170,001–$214,000 NA $13 + Plan Premium

Threshold Limits:

Speech and Language & Physical

$107,001–$133,500 $$214,001–$287,000 NA $33 + Plan Premium

Therapy—$3,700

#133,501–$160,000 $$267,001–$320,000 NA $54.20 + Plan Premium

20 Occupational Therapy—$3,700 2018 Physical(PT)/Occupational

Therapy(OT)/Speech and Language Outpatient

Limits

• You may qualify for an exception to the

Therapy Cap Limits, if the Therapist can establish

that the services are “medically reasonable

and necessary”

• Note: Before your therapist provides services,

which are not medically reasonable and