6 DE FEBRERO 2020 • 35

NOTAS LEGALES

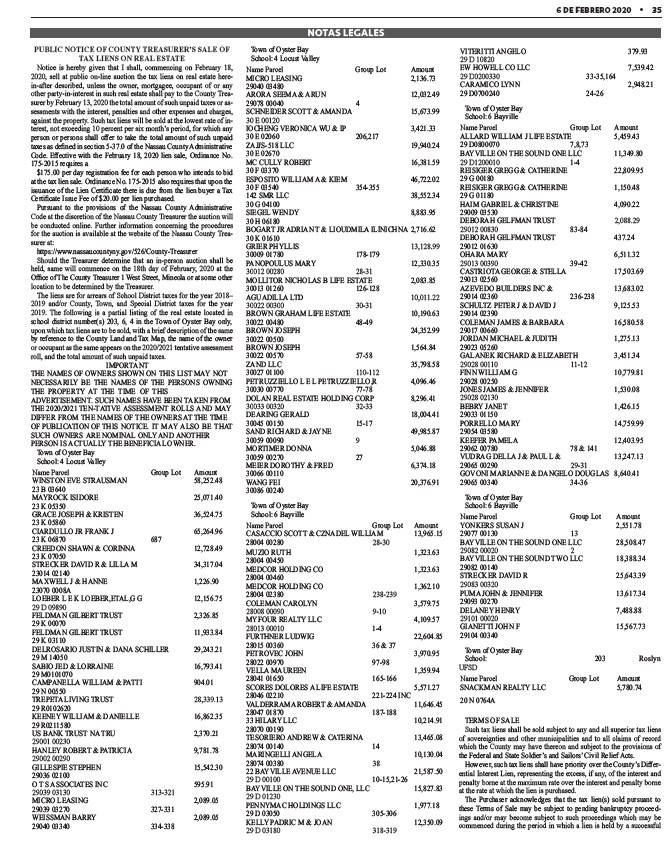

PUBLIC NOTICE OF COUNTY TREASURER’S SALE OF

TAX LIENS ON REAL ESTATE

Notice is hereby given that I shall, commencing on February 18,

2020, sell at public on-line auction the tax liens on real estate herein

after described, unless the owner, mortgagee, occupant of or any

other party-in-interest in such real estate shall pay to the County Treasurer

by February 13, 2020 the total amount of such unpaid taxes or assessments

with the interest, penalties and other expenses and charges,

against the property. Such tax liens will be sold at the lowest rate of interest,

not exceeding 10 percent per six month’s period, for which any

������������������������������������������������������������������������������������������������������������������������������������������

��������������������������������������������������������������������������������������������������������������������������������������������

��������������������������������������������������������������������������������������������������������������������������������������

��������������������������������������

����������������������������������������������������������������������������������������������������������������������������������������

��������������������������������������������������������������������������������������������������������������������������������������������������

����������������������������������������������������������������������������������������������������������������������������������������������

����������������������������������������������������������������������������������������������������

������������������ ������ �������� ���������������������� ������ �������� �������������� �������������� ������������������������������

Code at the discretion of the Nassau County Treasurer the auction will

be conducted online. Further information concerning the procedures

for the auction is available at the website of the Nassau County Treasurer

at:

������������������������������������������������������������������������������������������������������

Should the Treasurer determine that an in-person auction shall be

held, same will commence on the 18th day of February, 2020 at the

������������������������������������������������������������������������������������������������������������������������������������������

location to be determined by the Treasurer.

The liens are for arrears of School District taxes for the year 2018–

2019 and/or County, Town, and Special District taxes for the year

2019. The following is a partial listing of the real estate located in

����������������������������������������������������������������������������������������������������������������������������������������

upon which tax liens are to be sold, with a brief description of the same

��������������������������������������������������������������������������������������������������������������������������������������

or occupant as the same appears on the 2020/2021 tentative assessment

roll, and the total amount of such unpaid taxes.

�� �� ����������������������

����������������������������������������������������������������������������������������������

������������������������������ �������� ������������ ������ �������� ���������������� ��������������

�������� ������������������ ������ �������� ���������� ������ ����������

����������������������������������������������������������������������������������������������

����������������������������������-����������������������������������������������������������������

������������������������������������������������������������������������������������������������

���������������������������������������������� ���������������� ������������������������ ����������������

���������� ������������������������������������������������������������������������

��������������������������������������������������������������������������������

������������������������������������

����������������������������������������������

Name Parcel ������������������ ������������

������������������������������������������ ������������������

��������������������

������������������������������ ������������������

��������������������

�������������������������������������������� ������������������

��������������������

���������������������������������������� ������������������

�������������������� ������

���������������������������������������������� ������������������

��������������������

���������������������������������������������������� ������������������

����������������������

���������������������������������� ����������������

����������������������

�������������������������������������������������������� ������������������

29 D 09890

������������������������������������������ ����������������

��������������������

������������������������������������������ ������������������

��������������������

������������������������������������������������������������������ ������������������

��������������������

���������������������������������������� ������������������

����������������������

���������������������������������������������������� ������������

��������������������

���������������������������������������� 28,339.13

����������������������

�������������������������������������������������� ������������������

����������������������

���������������������������������������� ����������������

29001 00230

������������������������������������������������ ����������������

29002 00290

���������������������������������� ������������������

����������������������

���������������������������������������� ������������

29039 03130 313-321

�������������������������� ����������������

���������������������� ��������������

���������������������������� ����������������

���������������������� ��������������

������������������������������������

����������������������������������������������

Name Parcel ������������������ ������������

�������������������������� ����������������

����������������������

������������������������������������ ������������������

���������������������� ��

������������������������������������������������ ������������������

30 E 00120

������������������������������������������������ ����������������

�������������������� ��������������

�������������������������� ������������������

��������������������

������������������������������ ������������������

��������������������

�������������������������������������������������� ������������������

�������������������� ��������������

���������������������� ������������������

��������������������

������������������������ ����������������

��������������������

�������������������������������������������������������������������������������� ����������������

��������������������

�������������������������� 13,128.99

���������������������� ��������������

������������������������������ ������������������

30012 00280 28-31

�������������������������������������������������������������� ����������������

���������������������� ��������������

�������������������������� 10,011.22

30022 00300 30-31

������������������������������������������������ ������������������

���������������������� ����������

������������������������ ������������������

����������������������

������������������������ ����������������

���������������������� ����������

���������������� ������������������

���������������������� 110-112

������������������������������������������������������������������ ����������������

���������������������� ����������

������������������������������������������������������������ ����������������

30033 00320 32-33

���������������������������� ������������������

���������������������� ����������

���������������������������������������� ������������������

���������������������� 9

���������������������������� ����������������

���������������������� ����

���������������������������������������� ����������������

����������������������

���������������� ������������������

����������������������

������������������������������������

������������������������������������

Name Parcel ������������������ ������������

���������������������������������������������������������������� ������������������

���������������������� 28-30

�������������������� ����������������

����������������������

���������������������������������� ����������������

����������������������

���������������������������������� ����������������

���������������������� 238-239

������������������������������ ����������������

28008 00090 9-10

���������������������������������� ����������������

28013 00010 ������

������������������������������ ������������������

���������������������� ��������������

�������������������������� ����������������

���������������������� ����������

�������������������������� ����������������

���������������������� ��������������

�������������������������������������������������������� ����������������

���������������������� ����������������������

���������������������������������������������������� ������������������

���������������������� ��������������

�������������������������� ������������������

����������������������

������������������������������������������������������ ������������������

���������������������� ����

���������������������������������� ������������������

���������������������� 38

�������������������������������������������� ������������������

29 D 00100 ����������������������

������������������������������������������������������������ ������������������

29 D 01230

������������������������������������������ ����������������

�������������������� ��������������

������������������������������������������ ������������������

29 D 03180 318-319

�������������������������������� ������������

29 D 10820

�������������������������������� ����������������

29 D0200330 ������������������

�������������������������� ����������������

���������������������� ����������

������������������������������������

������������������������������������

Name Parcel ������������������ ������������

�������������������������������������������������������� ����������������

���������������������� ������������

���������������������������������������������������������� ������������������

29 D1200010 ������

���������������������������������������������������� ������������������

��������������������

���������������������������������������������������� ����������������

��������������������

������������������������������������������������ ����������������

����������������������

������������������������������������������ 2,088.29

29012 00830 ����������

������������������������������������������ ������������

����������������������

�������������������� ����������������

29013 00390 ����������

�������������������������������������������������� ������������������

����������������������

�������������������������������������������� ������������������

���������������������� ��������������

�������������������������������������������������� ����������������

����������������������

���������������������������������������������� ������������������

����������������������

���������������������������������������������� ����������������

����������������������

������������������������������������������������������ ����������������

29028 00110 11-12

���������������������������� ������������������

����������������������

�������������������������������������������� ����������������

29028 02130

���������������������� ����������������

����������������������

�������������������������� ������������������

����������������������

�������������������������� ������������������

���������������������� ����������������

�������������������������������������������������� ������������������

���������������������� 29-31

������������������������������������������������������������������ ����������������

���������������������� ����������

������������������������������������

������������������������������������

Name Parcel ������������������ ������������

������������������������������ ����������������

���������������������� 13

���������������������������������������������������������� ������������������

29082 00020 2

���������������������������������������������������������� ������������������

����������������������

�������������������������������� ������������������

29083 00320

���������������������������������������� ������������������

����������������������

�������������������������� ����������������

29101 00020

������������������������������ ������������������

����������������������

������������������������������������

���������������� ���������� ��������������

UFSD

Name Parcel ������������������ ������������

�������������������������������������� ����������������

��������������������

��������������������������

Such tax liens shall be sold subject to any and all superior tax liens

of sovereignties and other municipalities and to all claims of record

which the County may have thereon and subject to the provisions of

������������������������������������������������������������������������������������������������������������������������������

��������������������������������������������������������������������������������������������������������������������������������������-

ential Interest Lien, representing the excess, if any, of the interest and

penalty borne at the maximum rate over the interest and penalty borne

at the rate at which the lien is purchased.

�������� �������������������� �������������������������� ���������� �������� �������� ���������������� ���������� ������������������ ������

��������������������������������������������������������������������������������������������������������������������������������-

ings and/or may become subject to such proceedings which may be

commenced during the period in which a lien is held by a successful